Trading 0 Forex Spread

The difference between ask and bid price is the forex spread. in the above example, the spread in pips would be (1. 1252-1. 1251) = 0. 0001. the pip value on usd-based pairs is identified on the 4th digit, after the decimal. this means that the final forex trading 0 forex spread spread is 0. 1 pips. call trade with the no 1 broker for forex trading* spreads as low as 02 on commissions reduce trading costs by up to 15% with rebates** market leader with proven financial strength open per the jan 2019 retail forex obligation published by the cftc **conditions apply learn Spreads. our forexspreads vary depending on underlying market liquidity. the more liquid the market, the narrower our spread as low as 0. 8 pips. as the underlying market spread widens, so does ours but only to our maximum cap. forex overnight charges. the overnight funding fee is calculated using the tom-next rate. Zero spread forex brokers by press release january 21, 2020, 1:21 pm • posted in brokers news in forex trading, the difference between a bid price and an asking price is known as a spread.

Zero pip spread forex brokers. once the technology-driven trading environment appeared and showed its growing demand along with increasing trader’s awareness, many of the brokers and trading providers included into their offerings low-cost solution.. within the market there are situations happening while the intensity on both buy and sell orders are in high demand, which means that the. futures, tick-by-tick quotes see more cfd-forex dax spread only 0,8 pips winner of every major broker comparison see more stocks over 20 markets available 1 cent per share, no monthly minimum see more trading tools free and top-of-the-range included See more videos for forex trading 0 spread. Zero pip spread forex brokers. once the technology-driven trading environment appeared and showed its growing demand along with increasing trader’s awareness, many of the brokers and trading providers included into their offerings low-cost solution.. within the market there are situations happening while the intensity on both buy and sell orders are in high demand, which means that the.

10 Trusted Forex Broker With Zero No Spreads Comparison

*includes all valid trade and orders requests, excluding those entered on the metatrader platform. forex. com's execution statistics represent orders executed on forex. com's suite of trading platforms during market hours between november 29, 2019 5:00 pm et and december 31, 2019 5:00 pm et for forex. com's us entity only, excluding trades/orders entered on the metatrader platform. Ours start at just 0. 8 for spread bets on the trading 0 forex spread uk100 and us30 index on a standard account and zero spreads on spread free accounts. margins the minimum cost of a spread bet has margins from 5% in indices and 3. 33% on major forex markets. Forex spread betting is a category of spread betting that involves taking a bet on the price movement of currency pairs. a company offering currency spread betting usually quotes two prices, the. The concept of commission-based trading is closer to your mindset than that of the spread-based trading. you want your charts to display all the correct price levels no matter if you buy or sell. advertisements: — get free forex signals with 87% success to your what'sapp on a daily basis! >>>.

10 Trusted Forex Broker With Zero No Spreads Comparison

A true ecn forex broker with competitive spreads starting with zero pips and averaging 0. 45 pips, fp markets the best lowest spread forex broker classification. regulated by asic, this australian regulated broker claims to offer the ultimate trading experience to its customers. Trading derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary. raw spread accounts offer spreads from 0. trading 0 forex spread 0 pips with a commission charge of usd $3. 50 per 100k traded. standard account offer spreads from 1 pip with no additional commission charges. It’s just built into the bid/ask spread! how is the spread in forex trading measured? the spread is usually measured in pips, which is the smallest unit of the price movement of a currency pair. for most currency pairs, one pip is equal to 0. 0001. an example of a 2 pip spread for eur/usd would be 1. 1051/1. 1053.

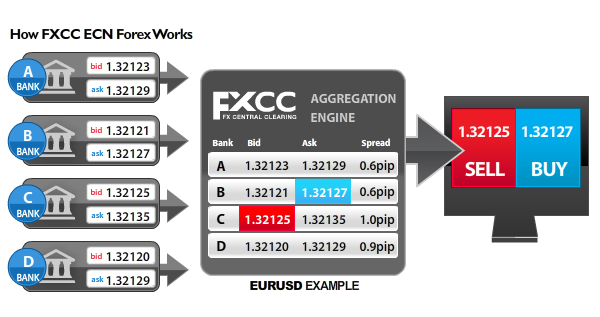

Thus, the spreads will start from 0 pips through the received interbank quotes, while trading costs are most commonly charged by the fixed commission per trade. the zero spread forex brokers are typically ndd, stp or ecn companies that provides direct access to the market and deep liquidity. Zero spread accounts allow you to trade with 0% between the bid and ask price. instead of making money on the spread, brokers with zero spread accounts typically charge a commission, allowing you to better predict the cost of your trades. here's a comparison of the trading 0 forex spread top forex brokers with zero spread accounts in 2020. Apr 29, 2020 · currency trades in forex typically involve larger amounts of money. as a retail trader, you may be trading only one 10,000-unit lot of gbp/usd. but the average trade is much larger, around one million units of gbp/usd. the 0. 0004 spread in this larger trade is 400 gbp, which is a much more significant commission.

Trading forex without spreads offers an opportunity to know your entry and exit levels precisely. it also allows calculating the non-loss expenses of trading beforehand. spreadless accounts can be critical for execution of some strategies that require the same ask and bid prices in the quote. Jan 21, 2020 · zero spread forex brokers by press release january 21, 2020, 1:21 pm • posted in brokers news in forex trading, the difference between a bid price and an asking price is known as a spread. Forexspread in forex trading is defined as the difference between the buying (ask) and the selling (bid) in the currency market. sometimes the buying price may be a bit higher which may result in. Therefore, in forex trading the difference between ask and bid is called “spread”. a spread represents brokerage service costs and typically replaces transactions fees. forex brokers applying a spread fee are called market makers but they are not the only type of broker available.

How To Understand The Forex Spread

Understanding the spread is an important part of your forex education. learn how to calculate forex spreads and costs, and read expert spread trading tips.

10 trusted forex broker with zero (no) spreads comparison.

Spread account: 1 lot eur/usd with 1. 0 pip spread = $10 spread fee. on a zero (no) spread account you are paying the most of the time $3. 5 per 1 lot trading (commission) zero spread account: 1 lot eur/usd with 0. 0 pip spread = $3. 5 spread fee. in conclusion, the zero spread account is 65% 50% cheaper than a normal spread account. Save trading fees by using a low spread forex broker. overall, we tested more than 50 forex brokers in 7 years of trading time and trading fees are very important to check. the most brokers are offering spread based account types and a few are offering a zero spread account in addition.

Belum ada Komentar untuk "Trading 0 Forex Spread"

Posting Komentar